When it comes to lawful use applications for HMOs either C4 or Sui Generis of any size the 4 year rule apply and not the 10 year rule,

This is because Houses in Multiple occupation are considered as dwellinghouses not only from a planning stand point but also from a council chargeable tax.

This is an already established fact because sa number councils throughout England and Wales have applied the 4 year rule for HMOs of any scale including large sui generis.

The reason for considering HMO Dwelling houses from a Legal Standpint. The reasons are multiple.

1 The number one reason is that they are effectively by law still dwelling houses even if occupied by multiple unrelated people grouped in households. This is recognized by a number of councils in England and Wales. Infact Councils around England and Wales have already issued several Lawful Certificate Developments applying the 4 year rule. They also only state that thy treat any HMO as a Dwellinghouse.

2. It is not only the council legal department considering them as dwelling houses in their own right but also the Highest court in the country through an important ruling have classed them as dwelling houses holding any right on pair to any C3 dwelling house.

3 HMOs are dwelling houses also as a council Tax Stand point.

4. The lower courts also view the tenants of any HMO as residing in a dwelling house, therefore granting them the same tenant rights as any other dwelling house. In essence lower courts in England and Wales view the rooms residents of any HMO as “tenants residing in a single dwelling house”

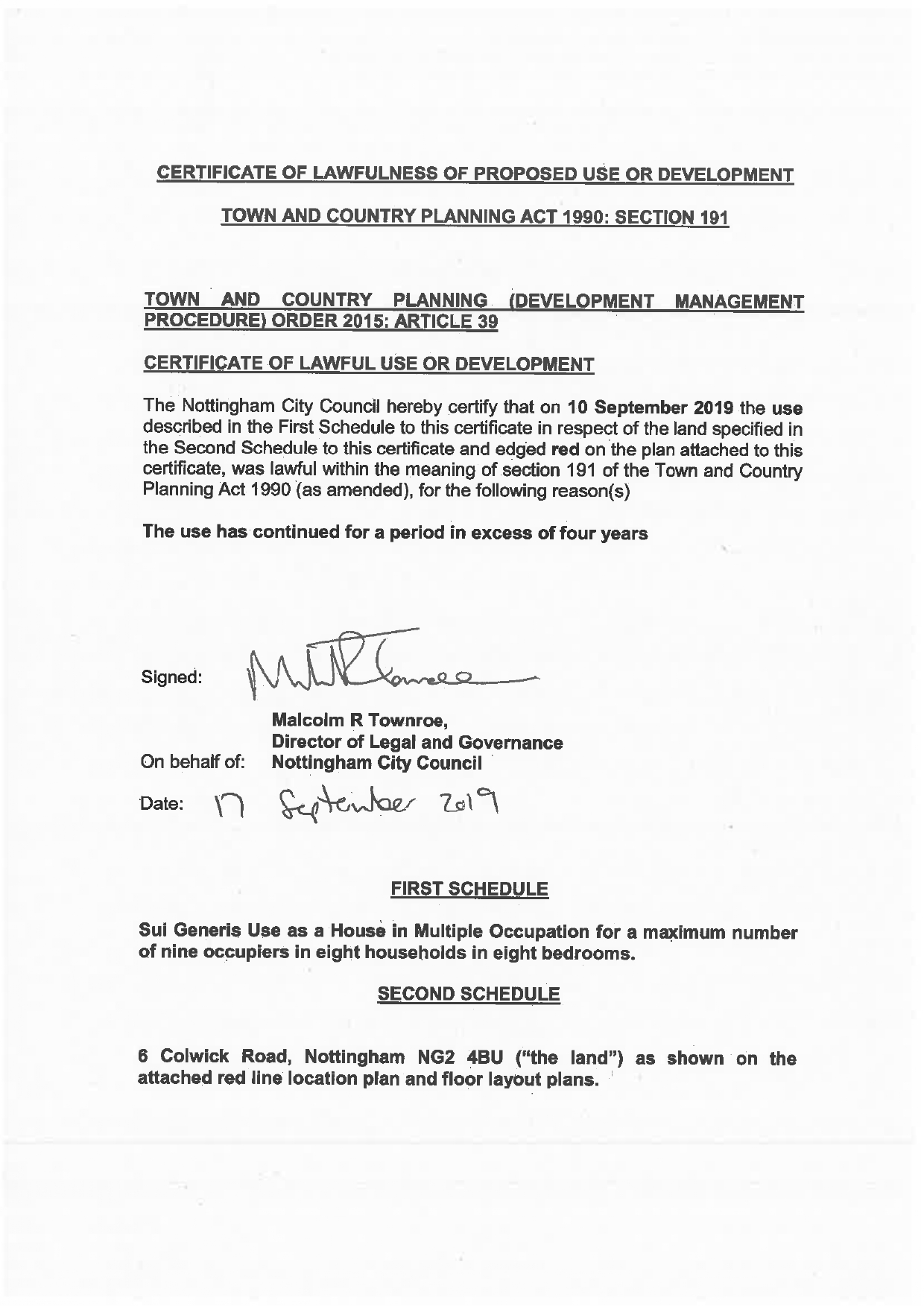

Example of council using the 4 year rule applied to sui generis HMO.

As you see the legal criterion used is the 4 year rule, “the use has continued for a period in excess of 4 years”

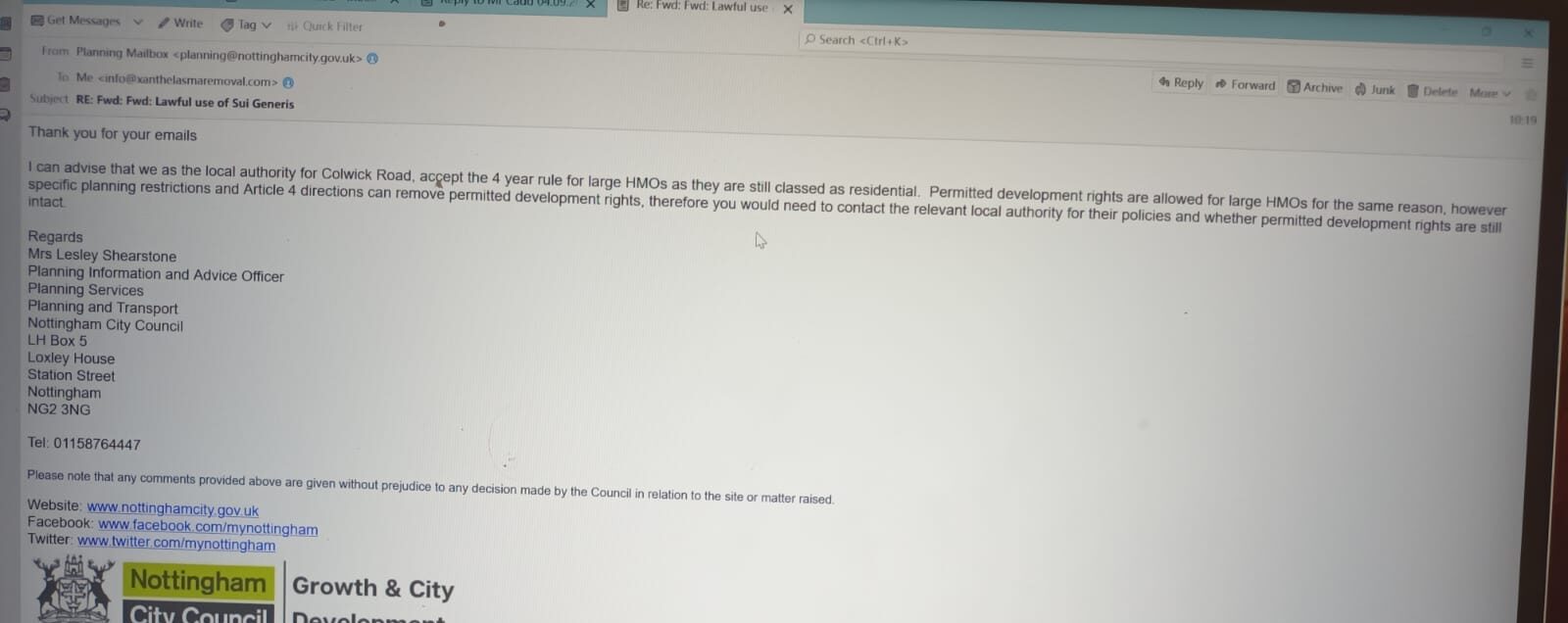

Also see how Nottingham council considers HMO of any scale residential dwellings in an email.

It is now a consolidated interpretation of the law that HMOs are to be considered to be dwelling houses, (this was also solidified by the latest HIGH court ruling in 2022. See the entire high court ruling and reasoning https://www.bailii.org/ew/cases/EWHC/Admin/2022/2051.html )

As it is clear from the High court ruling HMOs of any size are to be classed and treated as Dwelling houses no matter what other different view may be taken by any other party, Additionally this high court ruling clears up any possible interpretation disputes among different councils or entities.

Therefore the official undisputed interpretation of the law is that HMOs are dwelling houses.Hence, it is clear that it is the official and consolidated interpretation in England and Wales is that HMOs of any size have been treated and are to continued to be regarded as Dwelling house.

Even if there were to be an argument that the interpretation of the law can vary (which we have already amply demonstrated it is not the case) the concept of the less stringent rule applies when there might be two or more conflicting interpretations of the law In the same jurisdiction. Hence, given all the above and more, it is clear that the 4 year rule has been applied and applies to all sizes of HMOs.

In case a Sui Generis HMO that has Immunity from planning enforcement due to the 4 year rule. In case an enforcement action against its use as such is imposed it may be very difficult to enforce. This is because:

1 the enforcement notice could be unlawful (therefore the council could face successful civil lawsuit)

2 Any attempted prosecution in connection to such use (which has immunity due to the 4 year rule) is easily quashed by the defense by simply showing the information above.

In the light of all the above and several other evidence not presented here the 4 year rule applies to sui generis HMOs in England and Wales including in Lincoln of course.